Are Social Security Cost Of Living Adjustments Enough For Retirees?

What is a Cost-of-Living Adjustment?

A cost-of-living adjustment is an increase in your monthly social security benefits to combat inflation. If you are unfamiliar, inflation is a general increase in prices which decreases the purchasing power of the dollar.

The Social Security Administration announced that the cost-of-living adjustment is increasing by 1.3% for 2021, which equates to an average monthly benefit increase of $20 per CNBC.

With inflation rates nearing dangerous levels, it is important to be aware of the possibility that these cost-of-living adjustments may not be enough to maintain your lifestyle in retirement. Mary Johnson, a Social Security policy analyst for The Senior Citizens League, in a press release said the following: “When the prices of the goods and services that retirees depend on go through the roof, their Social Security benefits don’t buy as much, and that causes enormous financial stress for all retirees”. Knowing when and how to take your Social Security benefits correctly is crucial in preparing for retirement and combating inflation.

Request your Social Security Timing Report or call us today at 860-757-3644.

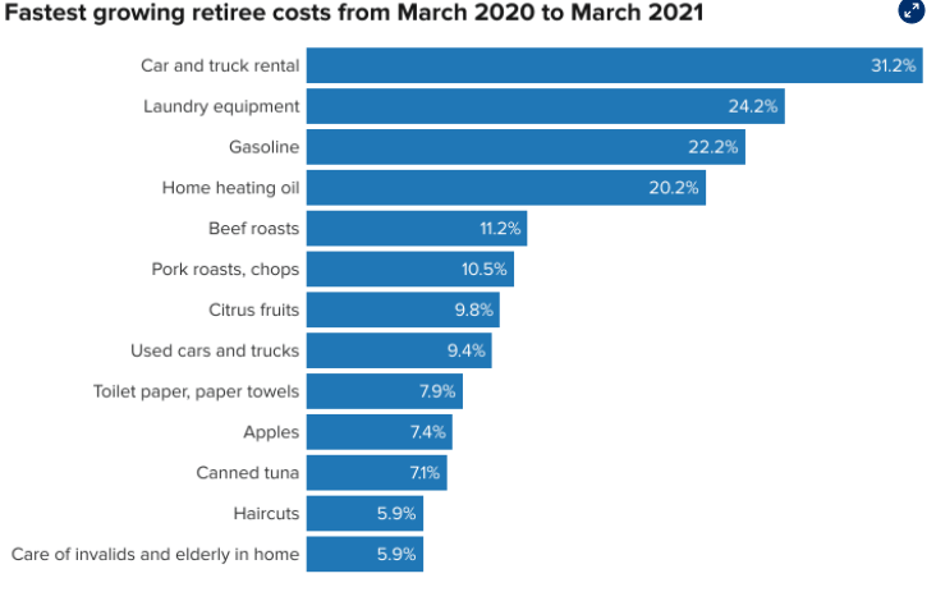

The below chart showcases how inflation has increased the prices of everyday goods and services.

In June Of 2021 Inflation Rose At Its Fastest Pace Since 2008

As you can see, the prices of everyday goods have increased dramatically over the past year. Inflation rose to 5.4 percent over the past year due to multiple factors including, supply chain issues and high demand as covid restrictions are easing. This is nearly double the expected inflation rate of 3% per year. This is the largest jump we have seen since August 2008 which was right before the financial crisis.

Inflation can erode the value of your money and create a stressful and unpredictable retirement.

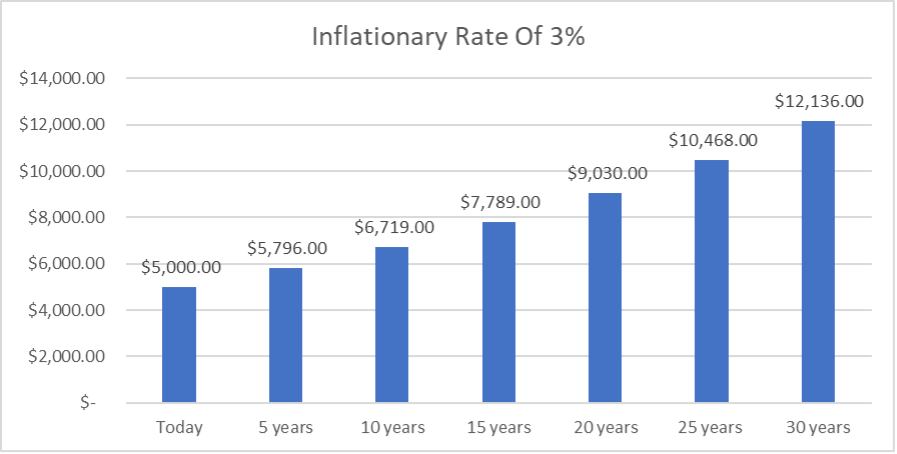

Did you know to have the same $5,000 purchasing power today, you will need $6,719 in 10 years adjusting for a more modest 3% inflationary rate? Inflation is the silent threat to maintaining your lifestyle in retirement. This chart shows how much you will need in your future retirement years based on this 3% inflation rate.

Since 2010, the average Cost of Living Adjustments per year has only been 1.4%, according to data from the Social Security Administration. Do you think this in enough to combat the looming inflation fears?

Have you noticed how inflation is affecting your budget?

Learn how the Retire Safety First approach can help protect you against inflation.

Contact us or call today at 860-757-3644.

At Retire Safety First we believe everyone has a right to a safe, secure and predictable retirement. Our goal is to remove the fear and uncertainty out of retirement, to provide peace of mind for retirement.